Chris Reeves

Chris Reeves

BA (Hons), PGDip, RICS Mediator, MCIArb,

2022 has seen inflationary pressures on a global scale. Israel is experiencing its highest inflation for a decade, which has been influenced by surging

oil and gas prices, sharp increases in critical construction materials, and skilled labour shortages.

In Q2 supply-chain disruption has eased but is likely to continue to be a key driver of insurers’ rising claims costs due to the uncertainty around Ukraine conflict and China’s Covid response, as many products are manufactured in China. This is impacting the insurance industry with repair costs increasing and supply chain pressures prolonging lead-in time for replacement equipment and materials.

In Q3, pricing volatility, labour market pressures and rising inflation is likely to continue, but further uncertainty is likely into Q4 with upcoming elections.

Introduction

Our Insurance Market Cost Outlook Q2’ for Israel, 2022 considers the impact of inflation, and increased material and labour pricing pressures on:

In May, the Bank of Israel has raised interest rates from 0.1% in Q1’ to 1.25% . Rates in Q2’ are now the highest since 2013. The Central Bank is also expected to increase rates in Q3 to counter rising inflation and price pressures.

The impact of the Russian-Ukraine conflict has caused a spike in global prices, particularly in wheat and fuel, partly due to sanctions .

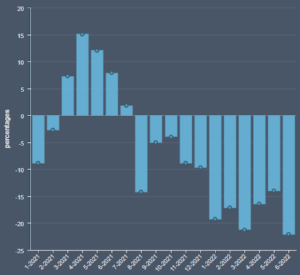

A Central Bureau of Statistics (CBS) survey for June 22’ showed that overall consumer confidence fell by 20.61% compared to May.

This is shown in Figure 1 below.

Construction Output

In 2022, Israel’s construction industry is forecast to grow by 2.6%.

The industry’s performance will be supported by the Government’s implementation of large-scale infrastructure projects during the period of 2020—2027, which aims to build 191.4 km of new light rail infrastructure with an estimated cost of ILS 73 billion (US$21.2 billion).

In June legislation requires all new homes to carry an energy efficient label to deliver on emissions targets which continues to draw significant investment.

One of the biggest issues is the cost of housing. Israel’s government plans to boost residential construction involves starts building 280,000 housing units by 2025 with hope this will stabilise the current increasing housing market.

Material Prices

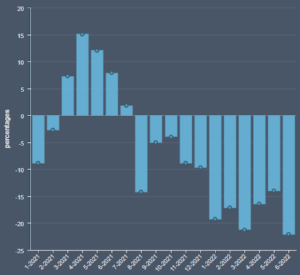

In Q1, material prices were on an upward trajectory with the price of steel jumping sharply in March, with rebar rising by 24% in that month alone, having remained fairly stable during

2021. Copper prices has also been volatile from Q1 to Q2 with 6% increase. In Q2 material prices continue their upward momentum due to on-going supply chain pressures and the Ukraine conflict. Increasing demand and tight supply will likely continue into Q3.

Figure 2: Shows % increases Q1 to Q2(f) 2022.

Israel has also been increasingly reliant on imported cement with domestic producers losing market share in recent years owing to cheaper imports from Turkey (which accounts for

around 60% of cement supplies in Israel).

Despite industry reports forecasting steep rises in materials the Government Price Indices of Input for Residential Buildings (Materials) show moderate increases 4.1% from Q1 to Q2. Costs for Commercial Building (Materials) also increased 3.7% Q1 to Q2.

However, this indices appear to suggest a lag between the actual prices increases being experienced by contractors, and those being officially captured. According to Israeli Builders Association (IBA), the indices are not able to keep up with the rapidly changing material prices. We have observed much higher material prices increases in the region, and anticipate these will eventually be reflected in official indices.

Supply Chain / Tendering

According to the IBA, some contractors are at risk of going out of business due to the upward pricing pressures. Some are also considering delaying or not bidding for projects with local authorities; the way in which these contracts are often structured, and pricing risk allocation, there is significant risk on developers already stretched by the lag in the price index.

The demand for long-lead equipment in the data centre sector has seen significant increases due to an IT boom. More data centre and crypto mining providers joining the market are increasing demand and outweighing the capacity adding pressure to material and labour supply chains.

Labour

Israel is experiencing a severe skilled labour shortage with unemployment at a two year low of 3.6%. The problem is further exacerbated by the Russia – Ukraine. This has reduced the availability of skilled labour available to the Israeli market.

However, in June the Israeli government announced various plans and projects aimed to ease the situation including issuing 3,500 permits (increasing number of such permits up to 12,000)12 for Palestinians to work in manufacturing and service sector positions.

According Yitzak Moyal (Chairman of the Construction and Wood Workers Union in Israel’s Histadrut labour federation) Israel is also looking to combat the shortage of construction workers by bringing in c15,000 Moroccan construction workers.

Impact on Insurers

For insurers in Israel the impact and volatility of inflation on construction costs, material and skilled labour shortages and longer lead times makes assessing values at risk and potential loss scenarios challenging: what was accurate just three months ago, may no longer be. Keeping abreast of market rates is imperative when assessing risk and claims exposures.

With material increases skilled labour shortages apparent, the impacts are affecting the reinstatement costs in the aftermath of a loss.

There is also a certain inevitability that, in line with inflation, claims values are likely to increase. What may not be fully appreciated is that longer reinstatement periods may have a greater financial impact for Insurers than rising labour or material unit prices. Longer periods affect physical damage claims and time-element exposures (such as business interruption or delay in start-up). In addition, Insured parties may be pressing for more frequent interim payments, and Insurers could be asked to fund acceleration costs to avoid costly delays.

With increased uncertainty on project pricing, there is increased use of fluctuation clauses and amendments in contracts. There is a risk that projects may be under insured.

With so many variables and volatility affecting Insurers’ reserving and reinstatement exposures, a proactive and expert-led approach to claims’ assessment is vital.

A LOOK AHEAD … The next 12 months

In Q3 the Israeli economy and construction sectors are likely to be impacted by several factors. The ongoing conflict in Ukraine will cause likely increases in construction material costs into Q3. At the end of June Parliament was dissolved and more elections were called; this may influence the political sentiment towards recruiting foreign labour needed to combat the on-going skilled labour pressures.

We are also anticipating a continued increase in Residential Buildings (material) costs and associated continued increases in housing prices

Chris Reeves

Chris Reeves

BA (Hons), PGDip, RICS Mediator, MCIArb,

2022 has seen inflationary pressures on a global scale. Israel is experiencing its highest inflation for a decade, which has been influenced by surging

oil and gas prices, sharp increases in critical construction materials, and skilled labour shortages.

In Q2 supply-chain disruption has eased but is likely to continue to be a key driver of insurers’ rising claims costs due to the uncertainty around Ukraine conflict and China’s Covid response, as many products are manufactured in China. This is impacting the insurance industry with repair costs increasing and supply chain pressures prolonging lead-in time for replacement equipment and materials.

In Q3, pricing volatility, labour market pressures and rising inflation is likely to continue, but further uncertainty is likely into Q4 with upcoming elections.

Introduction

Our Insurance Market Cost Outlook Q2’ for Israel, 2022 considers the impact of inflation, and increased material and labour pricing pressures on:

In May, the Bank of Israel has raised interest rates from 0.1% in Q1’ to 1.25% . Rates in Q2’ are now the highest since 2013. The Central Bank is also expected to increase rates in Q3 to counter rising inflation and price pressures.

The impact of the Russian-Ukraine conflict has caused a spike in global prices, particularly in wheat and fuel, partly due to sanctions .

A Central Bureau of Statistics (CBS) survey for June 22’ showed that overall consumer confidence fell by 20.61% compared to May.

This is shown in Figure 1 below.

Construction Output

In 2022, Israel’s construction industry is forecast to grow by 2.6%.

The industry’s performance will be supported by the Government’s implementation of large-scale infrastructure projects during the period of 2020—2027, which aims to build 191.4 km of new light rail infrastructure with an estimated cost of ILS 73 billion (US$21.2 billion).

In June legislation requires all new homes to carry an energy efficient label to deliver on emissions targets which continues to draw significant investment.

One of the biggest issues is the cost of housing. Israel’s government plans to boost residential construction involves starts building 280,000 housing units by 2025 with hope this will stabilise the current increasing housing market.

Material Prices

In Q1, material prices were on an upward trajectory with the price of steel jumping sharply in March, with rebar rising by 24% in that month alone, having remained fairly stable during

2021. Copper prices has also been volatile from Q1 to Q2 with 6% increase. In Q2 material prices continue their upward momentum due to on-going supply chain pressures and the Ukraine conflict. Increasing demand and tight supply will likely continue into Q3.

Figure 2: Shows % increases Q1 to Q2(f) 2022.

Israel has also been increasingly reliant on imported cement with domestic producers losing market share in recent years owing to cheaper imports from Turkey (which accounts for

around 60% of cement supplies in Israel).

Despite industry reports forecasting steep rises in materials the Government Price Indices of Input for Residential Buildings (Materials) show moderate increases 4.1% from Q1 to Q2. Costs for Commercial Building (Materials) also increased 3.7% Q1 to Q2.

However, this indices appear to suggest a lag between the actual prices increases being experienced by contractors, and those being officially captured. According to Israeli Builders Association (IBA), the indices are not able to keep up with the rapidly changing material prices. We have observed much higher material prices increases in the region, and anticipate these will eventually be reflected in official indices.

Supply Chain / Tendering

According to the IBA, some contractors are at risk of going out of business due to the upward pricing pressures. Some are also considering delaying or not bidding for projects with local authorities; the way in which these contracts are often structured, and pricing risk allocation, there is significant risk on developers already stretched by the lag in the price index.

The demand for long-lead equipment in the data centre sector has seen significant increases due to an IT boom. More data centre and crypto mining providers joining the market are increasing demand and outweighing the capacity adding pressure to material and labour supply chains.

Labour

Israel is experiencing a severe skilled labour shortage with unemployment at a two year low of 3.6%. The problem is further exacerbated by the Russia – Ukraine. This has reduced the availability of skilled labour available to the Israeli market.

However, in June the Israeli government announced various plans and projects aimed to ease the situation including issuing 3,500 permits (increasing number of such permits up to 12,000)12 for Palestinians to work in manufacturing and service sector positions.

According Yitzak Moyal (Chairman of the Construction and Wood Workers Union in Israel’s Histadrut labour federation) Israel is also looking to combat the shortage of construction workers by bringing in c15,000 Moroccan construction workers.

Impact on Insurers

For insurers in Israel the impact and volatility of inflation on construction costs, material and skilled labour shortages and longer lead times makes assessing values at risk and potential loss scenarios challenging: what was accurate just three months ago, may no longer be. Keeping abreast of market rates is imperative when assessing risk and claims exposures.

With material increases skilled labour shortages apparent, the impacts are affecting the reinstatement costs in the aftermath of a loss.

There is also a certain inevitability that, in line with inflation, claims values are likely to increase. What may not be fully appreciated is that longer reinstatement periods may have a greater financial impact for Insurers than rising labour or material unit prices. Longer periods affect physical damage claims and time-element exposures (such as business interruption or delay in start-up). In addition, Insured parties may be pressing for more frequent interim payments, and Insurers could be asked to fund acceleration costs to avoid costly delays.

With increased uncertainty on project pricing, there is increased use of fluctuation clauses and amendments in contracts. There is a risk that projects may be under insured.

With so many variables and volatility affecting Insurers’ reserving and reinstatement exposures, a proactive and expert-led approach to claims’ assessment is vital.

A LOOK AHEAD … The next 12 months

In Q3 the Israeli economy and construction sectors are likely to be impacted by several factors. The ongoing conflict in Ukraine will cause likely increases in construction material costs into Q3. At the end of June Parliament was dissolved and more elections were called; this may influence the political sentiment towards recruiting foreign labour needed to combat the on-going skilled labour pressures.

We are also anticipating a continued increase in Residential Buildings (material) costs and associated continued increases in housing prices